What Is A Surcharge?

You may have heard a lot about surcharging recently as it is becoming a popular option for merchants of all sizes. So what are the most important things you need to know about the surcharge? Well lets get into it. Simply put, a surcharge is an additional fee added to the total purchase amount to cover the cost of the credit card transaction.

Are There Different Types Of Surcharges?

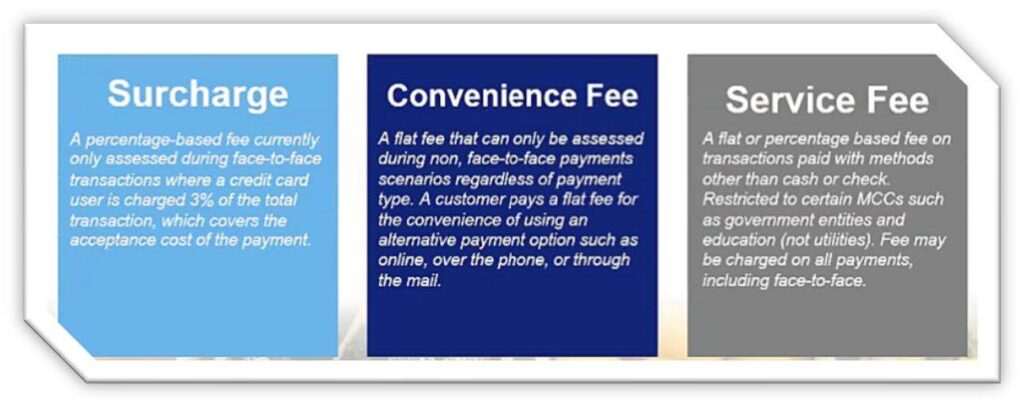

Here is a nice breakdown of what differentiates a Surcharge from other fees.

Did You Know?

The average number of credit cards that an American owns is four. That might sound like a lot but it’s really not when you consider the many different credit cards that are available from different banks. I personally own four credit cards as the allure of different types of rewards is too much for me to pass up. For this reason, among others, it is surprising to think that many businesses are still cash only.

We Accept Cash Only

Why do certain businesses still not accept credit cards? The main reason businesses shy away from credit card acceptance is due to the processing

costs. These usually range from anywhere between 1% to 4% of the purchase cost. This cost is what the surcharge will cover which is why it is such a game changer for businesses.

Will This Inconvenience Customers?

A common fear that business owners have when it comes to the idea of a surcharge is that it will scare off customers. Have no fear! A credit card surcharge can be avoided by the cardholder by choosing a lower cost payment method such as a debit card, ACH, eCheck, or cash transactions. In that regard, credit card surcharging becomes a tool to drive customer payment behaviors that benefit the business without limiting their payment choice. Also, depending on your average ticket size, this added surcharge fee will more likely than not be inconsequential to your customer.

Disclosure To Customers

There are some rules that businesses must abide by when it comes to implementing the surcharge feature. Namely, you must alert customers to the added surcharge at the point of sale. The disclosure must include the amount of the surcharge, the fact that the fee is being charged, and that it does not exceed the business’ cost to accept the credit card payment. The transaction receipt must also include the dollar amount of the surcharge.

How Can You Start Surcharging?

Now that you have a better idea of what surcharging is, how can you implement it? Introducing our new surcharge pricing program, C4: Credit Card Cost Control which is designed to meet the needs of any merchant who has brand loyal customers who are willing to pay a small surcharge when using credit cards. This easy to implement program also makes sure that you as the merchant are following all of the guidelines listed above that allows you to surcharge customers.

Hardware (And Software!) Options

The following fantastic line of Tetra terminals support the C4 pricing program: Desk 3500, Desk 5000, Move 5000. C4 is also available for eCommerce transactions via the great Converge platform! With different options available that range from a hosted payment page where the customer is redirected to customized templates on Converge before entering cardholder data to end to end API where cardholder remains on your website for the entire transaction. Much is possible with C4 on Converge!

Contact us today to find out more about how we can get you setup or with any questions you may have about the software or hardware!