For any business handling card payments, securing sensitive data is mandatory and there’s no workaround it. The Attestation of Compliance (AoC) is the formal proof that your business meets the PCI DSS (Payment Card Industry Data Security Standard) requirements, ensuring your systems protect customer payment information.

In essence, the AoC is a certificate that verifies your business has implemented the necessary security measures. It’s critical for maintaining trust with payment processors, banks, and customers alike.

Navigating this process can seem complex, but with the right approach—and the support of providers like ours: Premier Payments Online—compliance becomes far more manageable.

By the end of this article, you’ll not only understand what an AoC is but also have a clear roadmap for achieving and maintaining compliance all while keeping your business and customers secure.

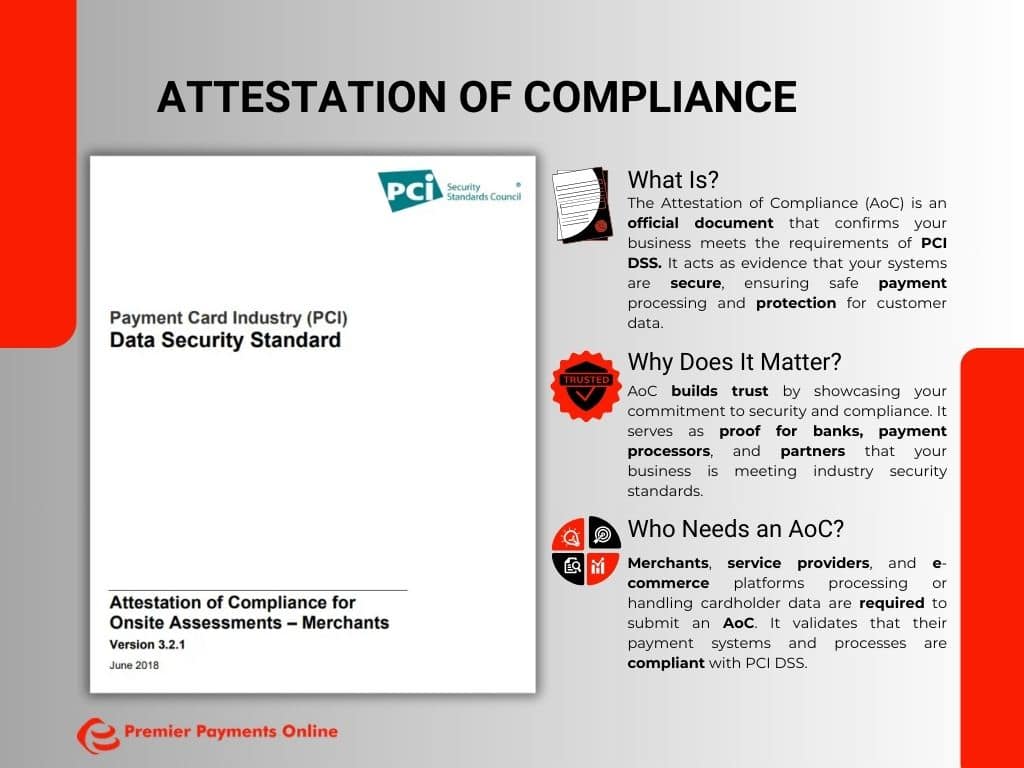

1. What is the Attestation of Compliance (AoC)?

Definition of the AoC

The Attestation of Compliance (AoC) is an official document that confirms your business complies with the Payment Card Industry Data Security Standard (PCI DSS). It’s issued after a thorough assessment of your systems, processes, and security measures to ensure they protect cardholder data. Think of it as a stamp of approval for your payment security practices.

Role of the AoC in PCI DSS

The AoC plays a vital role in demonstrating adherence to PCI DSS requirements. It acts as formal proof for payment processors, acquiring banks, or other stakeholders that your organization has taken the necessary steps to secure sensitive payment information. Without an AoC, you may face penalties, lose partnerships, or risk reputational damage due to perceived non-compliance.

Who Needs an AoC?

Not every business is required to submit an AoC, but if your organization handles payment card transactions, you may fall into one of the categories below.

| Business Type | Who Needs an AoC |

| Merchants | Businesses processing card payments at any volume. An AoC is required to validate compliance, especially for Levels 1–3 merchants. |

| Service Providers | Companies offering services like payment gateways, hosting, or storage that involve payment data processing. |

| E-Commerce Platforms | Businesses managing online transactions and storing or transmitting cardholder data digitally. |

| Third-Party Vendors | Any vendor interacting with cardholder data on behalf of another organization. |

Just as we discussed in the PCI DSS article, to comply, you need to follow security standards tailored to your transaction level and business type.

Why is the AoC Important for Stakeholders?

1. AoC Importance For Merchants

The AoC is indispensable for merchants as it directly impacts their ability to process card payments. Acquiring banks and payment processors often require an AoC as proof that you’re meeting PCI DSS requirements.

Without this document, your business risks being flagged as non-compliant, leading to fines, increased transaction fees, or even the suspension of your account.

2. AoC Importance For Service Providers

Service providers, such as payment gateways or hosting services, use an AoC to assure their clients that cardholder data is handled securely.

This document not only strengthens relationships with current clients but also opens doors to new business opportunities by building trust in your services.

3. AoC Importance For Payment Processors and Acquirers

Banks and processors rely on merchants’ and vendors’ AoCs to demonstrate that the entire payment ecosystem is secure. If a partner lacks compliance, it increases the financial institution’s liability, making the AoC a key component in maintaining these partnerships.

4. AoC Importance For Customers

Your AoC indirectly communicates to customers that their payment data is in safe hands. In a digital world where data breaches erode trust, demonstrating compliance is a significant step in fostering confidence and loyalty.

5. AoC Importance For Legal Protection

The AoC also serves as evidence of your commitment to security if your business is ever audited or investigated.

While compliance doesn’t guarantee immunity from breaches, having an AoC can mitigate penalties and show a proactive stance in case of incidents.

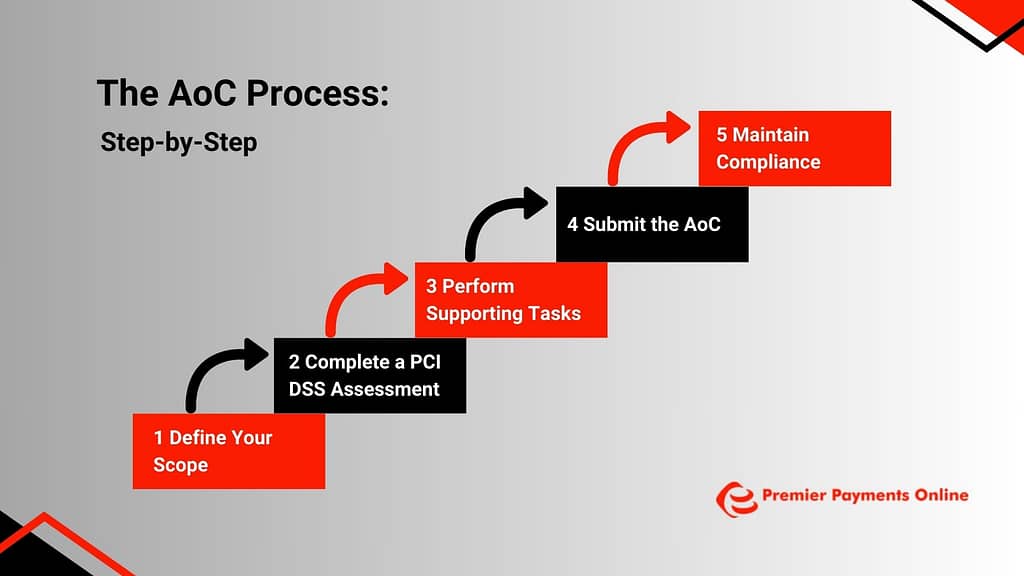

4. The Full Attestation of Compliance (AoC) Process: Step by step

Below is a step-by-step breakdown of the process, with clear actions for each stage:

Step 1: Define Your Scope

The first step is to identify all systems, processes, and networks involved in handling cardholder data. This is called “scoping,” and it ensures that all components interacting with sensitive data are included in your compliance efforts.

What To Do:

- Inventory all devices, systems, and processes handling payment information.

- Identify the people and third parties who interact with this data.

Tip: Premier Payments Online can assist in scoping by providing expert guidance on identifying and minimizing the data footprint through tokenization or other techniques.

Step 2: Complete Required Assessments

The type of assessment you complete depends on your merchant level:

- For Level 1 Merchants: Engage a Qualified Security Assessor (QSA) to conduct an external audit. QSAs ensure that your systems meet all 12 PCI DSS requirements.

- For Levels 2–4 Merchants: Complete a Self-Assessment Questionnaire (SAQ), which evaluates your compliance internally using standardized forms.

Actions To Follow:

- Determine your merchant level based on transaction volume.

- Work with a Qualified Security Assessor (QSA) or complete the Self-assessment questionnaire (SAQ) as required.

Tip: Premier Payments Online provides resources and partnerships with QSAs to streamline this step for businesses of any level.

Step 3: Provide Supporting Evidence

You must prepare documentation to validate your compliance efforts. This includes:

- Vulnerability scans (regularly scheduled).

- Penetration test results to confirm system security.

- Policies and procedures for managing data security.

What To Do:

- Collect and organize documentation showing compliance with each PCI DSS requirement.

Tip: Premier Payments Online offers access to tools for vulnerability scans and testing, making evidence collection easier.

Step 4: Submit the AoC

After completing your assessments and gathering evidence, you must submit your AoC to your acquiring banks or payment processors. This demonstrates that your business is fully compliant with PCI DSS.

Action To Follow:

- Submit the completed AoC, along with any requested evidence, to your acquiring bank or processor.

Tip: Premier Payments Online assists businesses by reviewing submissions for accuracy and completeness before they are sent.

Step 5: Maintain Compliance

Compliance doesn’t end once you receive your AoC. Regular monitoring, vulnerability scans, and annual assessments are required to maintain compliance.

What To Do:

- Implement continuous monitoring tools to detect vulnerabilities.

- Renew your AoC annually to keep your compliance up to date.

Tip: Premier Payments Online offers tools and guidance to help you maintain compliance year-round.

Summary Table: The AoC Process at a Glance

Step | What to Do | Premier Payments Online Role |

| 1. Define Scope | Identify all systems handling cardholder data. | Provide scoping expertise and tokenization tools. |

| 2. Assess Compliance | Complete SAQ (Levels 2–4) or work with a QSA (Level 1). | Partner with QSAs and provide SAQ resources. |

| 3. Provide Evidence | Submit vulnerability scans, tests, and security policies. | Offer tools for scans and evidence preparation. |

| 4. Submit AoC | Deliver AoC and documents to banks or processors. | Review and assist with AoC submissions. |

| 5. Maintain Compliance | Monitor systems and renew AoC annually. | Provide ongoing compliance monitoring and renewal support. |

5. Who Offers AoC Services?

Securing an Attestation of Compliance (AoC) requires expertise, reliable tools, and adherence to PCI DSS requirements. Various providers specialize in supporting businesses through this process, offering unique roles and capabilities.

Qualified Security Assessors (QSAs)

QSAs are certified experts approved by the PCI Security Standards Council (PCI SSC) to perform detailed PCI DSS assessments. They guide businesses through compliance, identify vulnerabilities, and ensure all requirements are met.

Their Role:

- Conduct comprehensive audits to verify PCI DSS adherence.

- Provide expert recommendations for improving security and meeting AoC standards.

- Issue AoCs for Level 1 merchants.

Key Providers:

- Trustwave: Offers end-to-end security solutions, including compliance assessments and reporting.

- ControlScan: Specializes in small and mid-sized businesses with tailored compliance programs.

- SecureTrust: Renowned for its robust PCI DSS assessment services for enterprises.

Payment Solution Providers

Payment processors and service providers often simplify the compliance process by offering resources, tools, and expert support. These companies can streamline the journey toward obtaining an AoC.

Their Role:

- Offer tools for scoping, documentation, and vulnerability scanning.

- Provide advisory support for completing Self-Assessment Questionnaires (SAQs).

- Help businesses prepare and submit AoC documents.

Payment Provider Example:

- Premier Payments Online (We): Assist businesses of all levels (SMBs, Retailers, E-commerce Companies, Service Providers, Enterprises, and More) with PCI DSS compliance.

From scoping systems to providing access to Approved Scanning Vendors (ASVs), we can support AoC preparation & submission while assuring ease and accuracy.

Approved Scanning Vendors (ASVs)

ASVs are PCI SSC-approved organizations specializing in vulnerability scanning, a critical requirement for the AoC process. These scans test systems for potential weaknesses that could compromise cardholder data security.

Their Role:

- Perform external vulnerability scans on networks and systems.

- Provide detailed reports for remediation and compliance documentation.

- Ensure alignment with PCI DSS scanning standards.

Key Providers:

- Qualys: Known for its cloud-based vulnerability scanning solutions.

- Rapid7: Offers advanced scanning tools with detailed analytics.

- Tenable: Provides scalable vulnerability scanning for businesses of all sizes.

Summary Table: Providers and Their Roles

| Provider Type | Role | Examples |

| Qualified Security Assessors (QSAs) | Perform assessments, issue AoCs, and guide compliance. | Trustwave, ControlScan, SecureTrust |

| Payment Solution Providers | Streamline compliance with tools and expert support. | Premier Payments Online |

| Approved Scanning Vendors (ASVs) | Conduct vulnerability scans and report on system weaknesses. | Qualys, Rapid7, Tenable |

Tips for Businesses Completing an AoC

Completing an Attestation of Compliance (AoC) may seem overwhelming at first, but with the right approach, it becomes a manageable process. Here are some practical tips to help businesses navigate the AoC journey efficiently:

1. Start Early

The AoC process requires careful planning, so it’s important to begin well before any deadlines. Compliance assessments, vulnerability scans, and system reviews can take time. Starting early allows businesses to address any weaknesses or gaps in their security measures before they face any penalties.

Why It’s Important:

- Avoid Last-Minute Stress: Starting early helps avoid rushed submissions and allows time for necessary fixes.

- Room for Improvement: Starting early gives businesses the flexibility to address any challenges during the compliance process.

2. Partner with Experts

The AoC process can be complex, particularly for businesses handling large amounts of cardholder data. Working with Qualified Security Assessors (QSAs) or service providers like Premier Payments Online ensures that businesses stay on track and comply with all relevant regulations.

Why It’s Important:

- Expert Guidance: QSAs and providers have the knowledge and experience to help businesses understand requirements and streamline the process.

- Ensure Accuracy: Experts can help businesses avoid common mistakes, ensuring that all steps are correctly followed to prevent issues in the future.

3. Keep Documentation Organized

An organized documentation system is critical throughout the AoC process. Businesses must maintain detailed records of their security assessments, vulnerability scans, and corrective actions taken. This ensures that all compliance activities are properly tracked and can be easily referenced when needed.

Why It’s Important:

- Easier Audits: Proper documentation ensures that audits go smoothly, reducing the risk of penalties.

- Accountability: Organized records allow businesses to quickly identify any weaknesses or areas of improvement during the compliance process.

Conclusion

With PCI DSS compliance, secure payment processing becomes vital to establishing trust with customers and partners. The Attestation of Compliance (AoC) indicates commitment to protecting sensitive payment information making it one of the most critical documents while dealing with card transactions, as the absence of it could lead to fines, reputational damage, and loss of many valuable partnerships.

It’s a breeze achieving AoC compliance with the right professionals in the picture. Joining hands with companies like Premier Payments Online will streamline the process of attaining AoC compliance. From vulnerability scans to providing resources for compliance management, we provide the tools and expertise you need to meet PCI DSS.

Act right away: let Premier Payments Online walk you through the AoC process to keep your company compliant. Contact us for details on our AoC offerings today!