We as a payment processor company understand the reality for online business owners. You’re working hard, serving your customers, and then there’s the inevitable: getting paid. Sending invoices out is one thing, but receiving timely payments can feel like a constant battle.

The invoicing process is incredibly important for any online business. However, using traditional invoicing methods often introduces many inefficiencies that can hurt your bottom line and operational capabilities.

In this article, we will help you discover the five typical problems online business owners deal with concerning invoicing and see how adopting electronic invoice (e-invoicing) solutions can provide real relief.

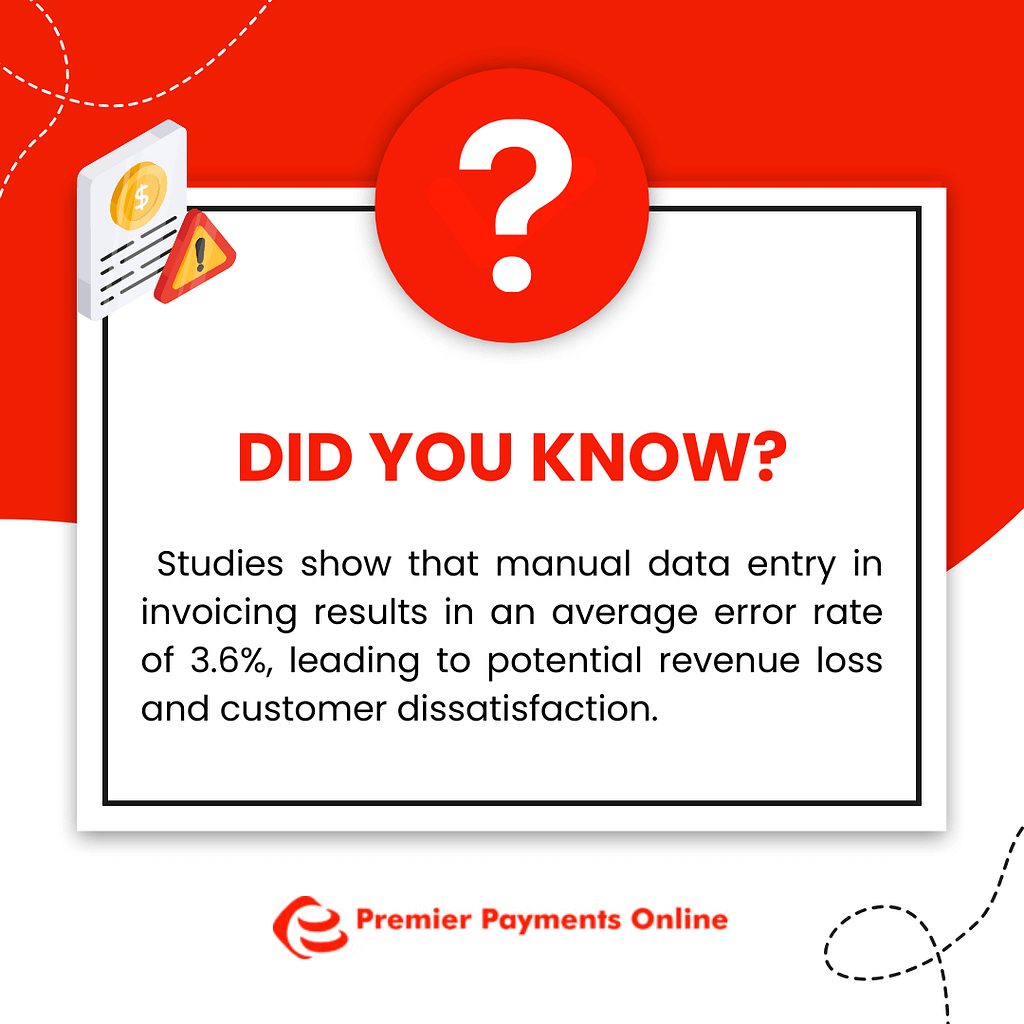

1. Human Errors: When Mistakes Slow Things Down

The Problem with Manual Invoicing

Creating invoices by hand, which often involves a lot of manual typing, calculation and transferring details by copy-pasting data, is where a number of problems begin. Something as simple as typing an amount incorrectly, a typo in the email, or even missing crucial data from your customer’s order can easily occur when a process relies on manual input.

The Result

These kinds of errors often create issues that waste a considerable amount of your time with back-and-forth conversations and a negative impact on the relationship you have with your customer due to the inaccuracies and the subsequent delay in the process.

E-Invoicing To The Rescue

By utilizing automated invoicing systems such as Premier Payments Billpay, you can significantly decrease errors because it removes most manual tasks related to entering data. Using software allows for all information to be included with calculations that are completed automatically ensuring every aspect of your invoice is completely accurate.

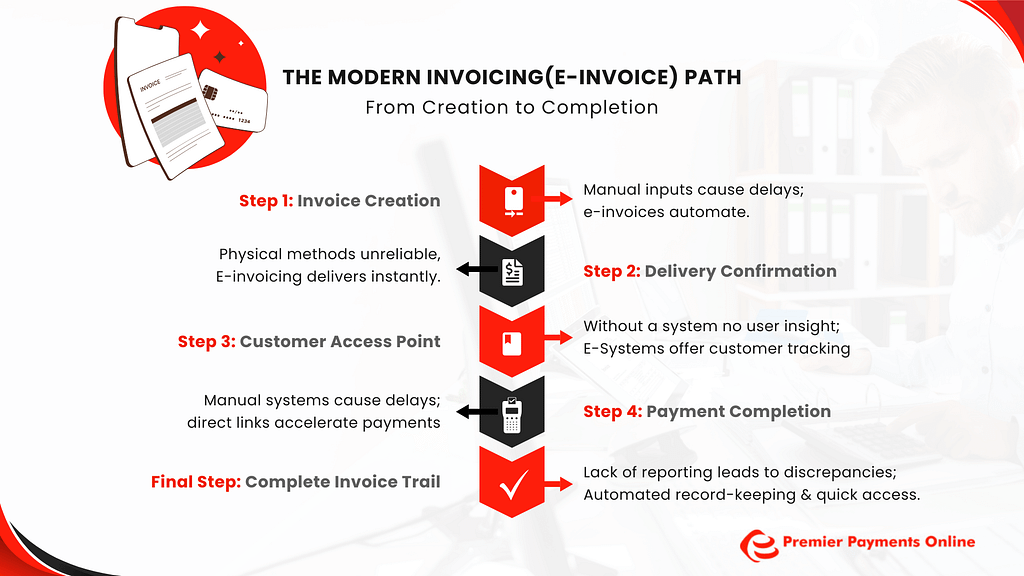

2. Payment Delays: Why You Wait So Long To Get Paid

The Reality of Traditional Methods

Traditional invoice methods like paper invoices or emailing PDF invoices tend to get overlooked. They often get lost in overflowing email inboxes, forgotten on someone’s desk, or buried in endless stacks of paper.

Impact

This is where the frustrating wait for payments starts. Delays such as these seriously slow down the cash flow for your business, adding uncertainty to your planning and spending.

Understanding the Impact of Invoice Methods on Payment Delays in this table:

| Invoice Method | Delivery Speed | Visibility to Customer | Risk of Overlooking | Potential Delay Impact |

| Paper Invoice (mailed) | Slow | Low | High | Significant cash flow delays |

| PDF Invoice (email) | Moderate | Moderate | Medium | Moderate delays and email clutter risk |

| E-Invoice | Instant | High | Low | Minimal cash flow disruptions |

How E-Invoicing Expedites Payments

E-invoicing platforms offer many capabilities that go beyond typical manual processes. These include immediately delivering invoices directly to the customer the moment it’s generated in your system. In addition, the platform also sets up reminders, encouraging prompt action. It allows customers to access your invoices at any time they desire through their personalized payment portal and enables multiple methods of payment through the invoice, including a “Pay Now” Button for online cards and bank transactions.

A Quick Look at How Premier Payments Can Help

For instance, Premier Payments Billpay, a fully featured electronic invoice processing system offers a custom series of notifications and follow-up prompts for customers so that payments don’t get overlooked which will speed up payments for your business.

3. Lack of Insight: Invoicing in the Dark

Why Traditional Invoices Cause Confusion

Many businesses are simply not aware of whether an invoice has even been opened or viewed, let alone forgotten about or needing specific follow up questions.

Negative Outcomes

The results are that missed payments lead to frustrating, unresolved queries that could have been prevented in advance. The uncertainty related to these missing links is one more problem when it comes to properly managing cash flow.

Why E-Invoicing Makes Your Invoicing More Transparent

Good E-invoicing platforms use invoice tracking as a built-in mechanism so you are fully in the loop at all times and are able to tell exactly what step the invoice has achieved, in relation to the entire payments process.

Tracking Your Invoices: The Benefit of Using Premier Payments

The detailed invoice tracking available in Premier Payments Billpay will allow your team to have peace of mind knowing each invoice status in a clear dashboard. Now your team is more aware and capable of strategically following up confidently.

4. Difficulty Organizing Records: When Accessing Old Data Is a Chore

How Ineffective Record Keeping Makes Things Difficult

Using hard copies and older or outdated systems makes organizing, locating and accessing past sales records a real issue for growing online business.

Real World Impact

This not only wastes valuable time during everyday transactions with your customers or regular sales reconciliation but when faced with auditing or simple customer requests for history can often become cumbersome for the whole business.

Comparison of Record-Keeping Methods:

| Method | Storage Method | Accessibility | Retrieval Time | Security | Organization | Scalability |

| Paper Invoices | Physical Filing | Limited | Slow | Low | Difficult | Not Scalable |

| Spreadsheets/Local Files | Digital Files | Moderate | Moderate | Moderate | Somewhat organized | Limited Scale |

| E-Invoicing Platforms | Cloud-Based | High | Fast | High | Simple | Highly Scalable |

Why E-Invoicing Simplifies Document Management

Going with Digital Invoicing solutions such as the Premier Payments platform enables simple storage of all sales and invoices in one cloud-based and safe repository so accessing that information quickly becomes incredibly easy.

Premier Payments and Its Record-Keeping Advantage

Premier Payments Billpay fully integrates into standard accounting packages such as QuickBooks and Sage. With features such as this, it is simple for teams to conduct record-keeping.

5. Security Risks: The Problem With Old Paper

Why Physical Documents Are a Security Weakness

Using paper can introduce multiple security threats including risk of theft or simple damages to physical documents that make them easy targets. This type of negligence in data can cause legal trouble and cause compliance risk in your daily operations

Reputation and Legal Implications

These sorts of risks are incredibly negative, causing loss in client trust by making their private details open to all sorts of illegal operations including malicious actions of fraud.

Security Risks: Comparing Invoice Methods

| Security Aspect | Paper Invoices | Emailing PDF Invoices | E-Invoicing Platforms |

| Risk of Loss/Theft | High | Low/Moderate | Very Low |

| Risk of Tampering | Moderate/High | Moderate | Low |

| Data Exposure | High | Moderate | Low |

| Encryption of Data | Not Applicable | Potentially | High |

| Secure Payment Channels | Not Applicable | Variable | Secure (Encrypted) |

| Audit Trail | Limited | Limited | Detailed & Logged |

| Compliance | Higher risk | Variable | Lower risk |

Protecting Sensitive Details

Advanced electronic invoicing platforms ensure high level protection through high-end data encryption along with secure, regulated payment processors. With electronic invoices, the transactions from Credit Card, ACH bank transfers etc are carefully supervised.

Why Every Small Business Should Implement E-invoicing Immediately.

Taking Steps Towards Future Business Success

Transitioning to E-Invoicing for all of your business is not simply adopting a more efficient solution; but making a forward move towards efficiency in day to day activities, business growth, financial consistency and client safety.

The Holistic Benefits of E-Invoicing:

| Benefit Area | Explanation | Examples of Impact |

| Operational Efficiency | Automates mundane, error-prone tasks, freeing up your team to focus on core activities | Less time spent creating and sending invoices, reduced administrative overhead, quicker task completion |

| Improved Cash Flow | Speeds up the entire billing cycle through instant delivery and faster payment processing | Faster payments from clients due to streamlined processes and easy pay options, reduced financial strain |

| Reduced Costs | Lower costs on materials, time consumption, error handling, and administrative requirements | Decrease in physical documents such as paper, ink etc. reduced time for handling client’s payments, and reduced time to manage paper/ digital filing processes. |

| Enhanced Security | Keeps financial data more secure using data encryption methods and secure transmission and digital systems | More confidence in transactions and customer information remains highly protected with digital end-to-end safety parameters |

| Greater Compliance | Ensures your sales operation adhere with legal standard with each invoice being fully auditable | Provides transparent processes, simplifies financial compliance audits, keeps records up to date according to all latest regulations. |

| Scalability & Flexibility | Offers the potential to adapt more quickly to business fluctuations including sudden or fast growth with streamlined cloud system | Easily increase transaction volume, add staff, make global transactions due to cloud platform, expand into more areas |

| Environmental benefits | Reduction of carbon footprint due to decrease use in Paper invoices | reduction of natural resources due to lack of need for print based documentation |

| Improved Customer Experience | Provide payment flexibility for clients through personalized portals | Quicker check outs due to direct Pay Button on online invoices or using client branded system |

Why it is crucial to your company

E-invoicing provides extensive benefits beyond simply sending invoices digitally. Its most important advantages are streamlined workflow due to eliminating unnecessary processes, higher cash flow because payments are quick and flexible and a decreased risk because transaction and data handling methods are highly encrypted. These are essential aspects for each online business looking for stability and success.

Detailed Look at Key Improvements:

| Improvement Area | Detailed Explanation | Traditional Method Challenges | E-Invoicing Solution |

| Error Reduction | Eliminates manual data entry which lowers the human errors and improves accuracy of billing | High rates of error, requires verification | Automated processes, calculation by system |

| Speed and Cash Flow | Instant payment receipt capabilities, allows clients many payment options | Long wait time for invoice, variable collection cycle. | Streamlines delivery and client access, direct ‘Pay Now’ buttons and secure client portals |

| Streamlined Operations | Digital handling eliminates unnecessary physical tasks that allows workers to do core jobs faster | Clutter of papers, hours wasted filing paper | Digital invoices accessible by any authorized personnel, less manual and repetitive work |

| High-Level Security | Safeguard information with the latest level security of online data encryption | Risk of theft, alterations to sensitive data | System protects confidential payment details |

How Premier Payments Simplifies Invoicing and Payments

Premier Payments Billpay is a system designed to provide online businesses all that’s needed for billing operations through all in one integrated software package.

Our Online Invoicing Features:

- Branded Payment Pages: Enhance customer perception and trust with payment portals designed for your business brand, reflecting your professionalism and making it a pleasant payment experience for customers.

- Adaptable Payment Options: Offer simple payment options like subscription services, flexible installments payments so that each transaction fits comfortably to what the client and business may need for success.

- Direct Syncs with your accounting platform: Fully integrate all sales transactions directly to commonly used platforms like QuickBooks or Sage ensuring you accounting team always has accurate, reliable and up to date figures for reporting needs.