Summary:

“This article explores the transformative power of invoice automation through real-world case studies and data-driven insights. It highlights how businesses across industries achieve rapid ROI, with cost reductions of up to 80% and efficiency gains cutting processing times from weeks to days.

Introduction:

Processing invoices costs most companies between $12-15 per document when done manually. This guide will show you how to reduce that cost to just $2-3 using practical automation tools and proven workflows, based on our real implementation data from 2024.

*Data and company names are anonymized for privacy and security.

What We’ll Cover in the Article:

- Basic vs. Automated Processing: Cost comparison tables and ROI calculations

- Step-by-step technical implementation guide using affordable tools

- Real case studies showing cost reduction (50-80% savings)

- Common technical challenges and budget-friendly solutions

- DIY automation steps vs. vendor solutions: When to use each

1. Understanding Invoice Processing Costs For Entreprises:

1.1 Manual Processing Breakdown:

Manual invoice processing involves several steps, each incurring hidden costs. Below is a breakdown of activities and their associated costs from a mid-sized manufacturing company handling 1,000 invoices per month:

| Activity | Time (mins) | Cost ($) | Why It Matters |

| Opening mail/email | 2 | 1.00 | Initial step for sorting invoices |

| Sorting, printing emails | 4 | 2.00 | Handling invoice documents |

| Data entry | 8 | 4.00 | Manual typing into system |

| Three-way matching | 10 | 5.00 | PO/Receipt/Invoice verification |

| Error checking | 5 | 2.50 | Finding and fixing typos |

| Filing/storage | 3 | 1.50 | Physical/digital filing of documents |

| Total | 28 mins | 14.00 | Total per invoice |

For a single invoice, the total cost can reach $14.00. However, the hidden costs increase when you factor in human errors, delays, and missed payment deadlines.

1.2 Real Cost Example: Company X (Before Automation)

Company X (hidden for privacy purposes) processes 1,000 invoices monthly. Here’s a snapshot of their manual processing costs:

| Component | Monthly Cost ($) | Annual Cost ($) |

| Processing Cost | 14,000 | 168,000 |

| Staff Required | 3 employees | 3 employees |

| Error Rate | 12% | N/A |

| Late Payment Penalties | 2,000/month | 24,000 |

| Total Cost | 16,000/month | 192,000/year |

This figure $192,000/year excludes costs for errors, compliance, and data storage.

1.3 Automated Processing Costs

Automation significantly reduces costs by replacing manual labor with technology. Here’s a breakdown of costs for small, medium, and large-scale businesses:

| Component | Basic ($) | Advanced ($) | Enterprise ($) |

| Software License | 500/month | 1,000/month | 2,500/month |

| Per Invoice Fee | 1.50 | 1.00 | 0.75 |

| Storage Cost | 0.10 | 0.10 | 0.10 |

| Training (one-time) | 1,000 | 2,500 | 5,000 |

Larger businesses often need enterprise-level automation solutions due to higher transaction volumes, complex workflows, and integration needs.

1.4 ROI Calculator (with Examples)

Let’s break down the cost savings using real-world scenarios. The ROI formula will help you determine how long it takes to recover your implementation costs through savings:

Example 1: Medium-Sized Business (5,000 invoices/month)

Current Costs (Manual Processing):

- Processing: $70,000/month

- Late Fees: $8,000/month

- Storage: $2,000/month

- Total: $80,000/month

Automated Processing Costs:

- Software License: $1,000/month

- Per Invoice Fee: $5,000/month

- Storage: $500/month

- Total: $6,500/month

ROA Calculations:

- Monthly Savings: $80,000 – $6,500 = $73,500

- Annual Savings: $73,500 * 12 = $882,000

- Implementation Cost: $50,000

- Payback Period: $50,000 ÷ $73,500 = 0.68 months

Example 2: Large Enterprise (50,000 invoices/month)

Current Costs (Manual Processing):

- Processing: $700,000/month

- Late Fees: $80,000/month

- Storage: $20,000/month

- Total: $800,000/month

Automated Invoice Processing Costs:

- Software License: $10,000/month

- Per Invoice Fee: $37,500/month

- Storage: $1,000/month

- Total: $48,500/month

ROA Calculations:

- Monthly Savings: $800,000 – $48,500 = $751,500

- Annual Savings: $751,500 * 12 = $9,018,000

- Implementation Cost: $200,000

- Payback Period: $200,000 ÷ $751,500 = 0.27 months

1.5 Hidden Cost Savings

Implementing automation also removes various hidden costs. Here’s a comparison of manual vs. automated savings:

| Cost Type | Manual Process ($) | Automated Process ($) | Annual Savings ($) |

| Late Payment Penalties | 24,000 | 2,400 | 21,600 |

| Early Payment Discounts | 0 | 36,000 | 36,000 |

| Storage (1,000 invoices) | 6,000 | 600 | 5,400 |

| Audit Preparation | 10,000 | 1,000 | 9,000 |

| Error Correction | 12,000 | 1,200 | 10,800 |

1.6 Implementation Cost Factors

Consider the following costs when setting up invoice automation. Costs depend on the solution you choose:

| Factor | Basic ($) | Advanced ($) | Enterprise ($) |

| Software (Annual) | 6,000 | 12,000 | 30,000 |

| Training (One-time) | 1,000 | 2,500 | 5,000 |

| Integration (One-time) | 5,000 | 15,000 | 25,000 |

| Maintenance (Annual) | 1,200 | 2,400 | 6,000 |

1.7 ROI Formula Breakdown

To calculate your return on investment, follow these two steps:

- Calculate Annual Savings:

(Manual Cost – Automated Cost) × 12 = Annual Savings

Example: ($80,000 – $6,500) × 12 = $882,000. - Calculate First-Year ROI:

(Annual Savings – Implementation Cost) ÷ Implementation Cost × 100 = ROI%

Example: ($882,000 – $50,000) ÷ $50,000 × 100 = 1,664% ROI

1.8 Quick Decision Matrix

Choosing the right solution depends on your invoice volume. Here’s a guide:

| Invoice Volume | Recommended Solution | Expected ROI | Payback Period |

| <500/month | Basic Automation | 200% | 6 months |

| 500-2,000/month | Advanced Automation | 500% | 3 months |

| >2,000/month | Enterprise Solution | 1,000%+ | 1-2 months |

Focus on your monthly invoice volume to determine which level of automation is right for your business.

2. Step-by-Step Technical Implementation Guide

Quick Implementation Matrix

| Business Size | Monthly Invoices | Recommended Approach | Estimated Setup Time |

| Small | <500/month | DIY + Basic Tools | 1-2 weeks |

| Medium | 500-2000/month | Premier BillPay | 2-3 days |

| Large | >2000/month | Enterprise Solution | 2-4 weeks |

2.1 DIY Implementation ($0-$200/month)

Tools Needed:

- Excel/Google Sheets: Free tools to create tracking and data management.

- Gmail/Outlook: Basic email communication with invoicing ($6/user/month).

- PDF Scanner App: Free or low-cost apps for digitizing physical invoices.

Setup Steps:

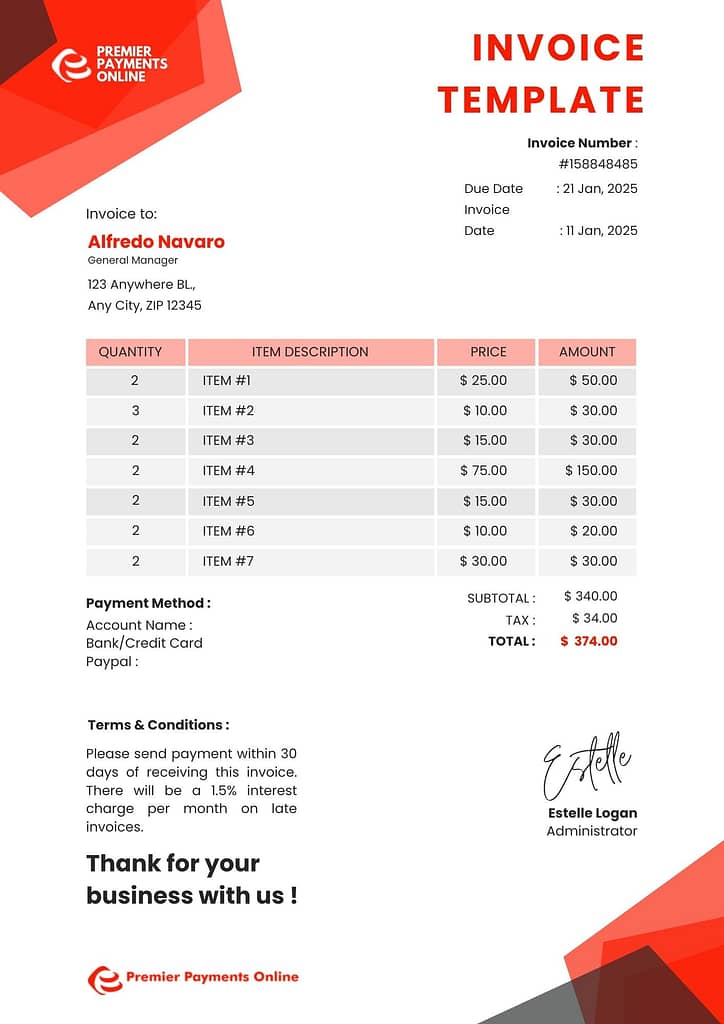

- Create Invoice Template: Design a simple invoice template that includes essential information such as invoice number, date, services/products, and amount due.

- Set Up Folder Structure: Organize your invoices by client and month for easy access.

- Establish Naming Convention: Create a consistent naming system for invoices (e.g., [ClientName][InvoiceNumber][Date]).

- Create Tracking Spreadsheet: Use Excel/Google Sheets to record invoice details, payments, and due dates.

- 📁Download This Free customizable Invoice Template

Example:

For a small business processing fewer than 500 invoices per month, you can handle the entire invoicing process using DIY tools like Excel and Gmail, which can be set up in 1-2 weeks at a low cost.

2.2 Basic Automation ($200-$500/month)

Tools Needed:

- QuickBooks/Xero: Accounting software ($30/month) to track invoices and payments automatically.

- Document Scanner: A one-time purchase of a scanner ($150) to digitize physical invoices.

- Cloud Storage: Monthly storage cost for invoices and related documents ($10/month).

Setup Steps:

- Install Accounting Software: QuickBooks or Xero integrates invoicing and payment processing.

- Configure Invoice Templates: Customize the software to match your branding and automate invoice creation.

- Set Up Payment Reminders: Set automatic reminders for overdue payments and invoices.

- Connect Bank Accounts: Link your bank accounts to the software to streamline reconciliation.

Example:

A medium-sized business processing 500 to 2,000 invoices per month can implement basic automation by leveraging accounting software and a cloud-based document management system. Setup takes about 1 week to configure.

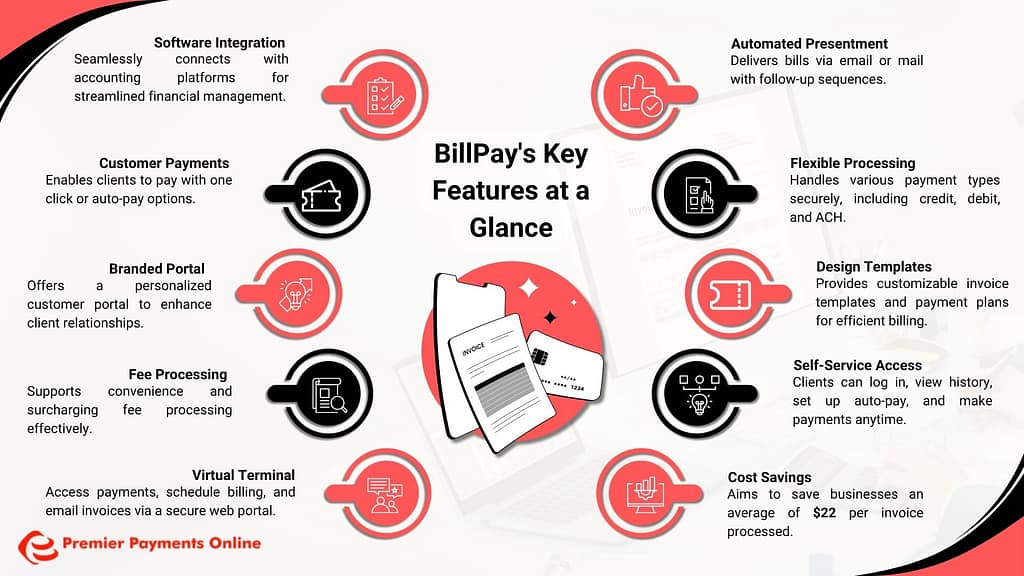

2.3 Premier BillPay Solution (Varies Based on Volume)

Key Features:

- One-Click Software Integration: Easy integration with your existing accounting software.

- Automated Reconciliation: Software reconciles payments automatically, reducing manual effort.

- Custom Follow-Up Sequences: Set up automated reminders and overdue payment sequences.

- Multi-Payment Options: Accept multiple types of payments (credit card, ACH, etc.).

- White-Labeled Customer Portal: This allows customers to manage their invoices and payments directly.

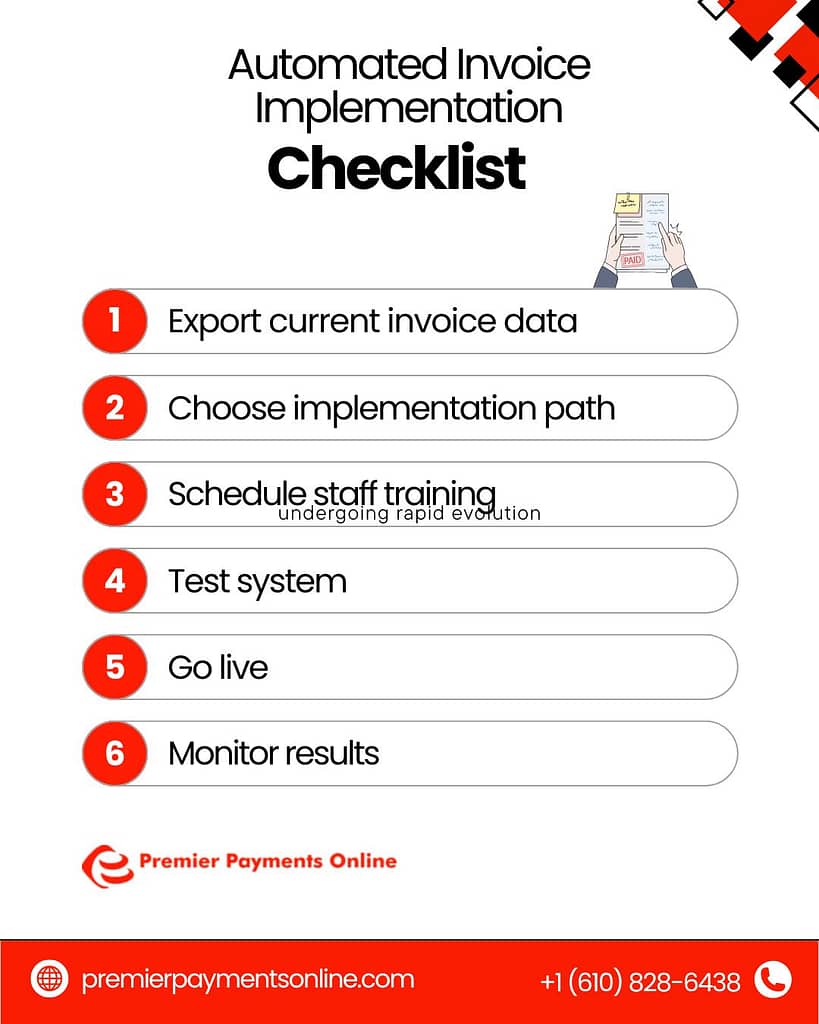

Implementation Steps:

Day 1: Setup

- Sign up for a free trial.

- Connect your accounting software and import your customer database.

Day 2: Configuration

- Customize invoice templates for your branding.

- Set up payment methods and configure automation rules for invoicing and follow-ups.

Day 3: Testing

- Send test invoices to ensure proper formatting and payment processing.

- Verify all automated features (reminders, payment tracking).

- Train your staff on using the new system.

ROI Calculator for Premier BillPay:

- Average savings per invoice: $22

- Monthly invoices: 1,000

- Potential monthly savings: $22,000

2.4 Enterprise Implementation

Recommended Stack:

- Premier BillPay: Core processing for invoices and payments.

- ERP System: Business management for other functions like inventory and HR.

- API Integrations: Custom solutions to integrate with other software and data sources.

Timeline:

| Week | Activity |

| Week 1 | System Setup |

| Week 2 | Data Migration |

| Week 3 | Staff Training |

| Week 4 | Go-Live |

- Cost: Pricing varies based on the size and complexity of the enterprise system.

For large enterprises processing over 2,000 invoices per month, an enterprise Invoicing solution (Like Billpay Invoicing for Large businesses) with API integrations and an ERP system will be required. The setup time will be longer (2-4 weeks), and there may be significant customization based on specific business needs.

Cost Comparison Table

| Feature | DIY | Basic Automation | Premier BillPay (SMB’s) | Enterprise “Billpay Entreprise” |

| Initial Cost | $0 | $500 | Free Trial | Free Trial |

| Monthly Fee | $6 (email) | $200 | Volume-based | Volume-based |

| Setup Time | 1-2 weeks | 1 week | 3 days | 4 weeks |

| Automation Level | None | Basic | Full | Custom |

| Integration | Manual | Limited | Full | Custom |

2.5 Why Choose Premier BillPay as your Enterprise Invoicing Solution?

Immediate Benefits:

- Save $22 on average per invoice in administrative costs.

- 24/7 access to a customer portal for both staff and clients.

- Automated reminders for overdue payments.

Technical Advantages:

- Software Agnostic: Compatible with all accounting software.

- Automated Reconciliation: No need for manual payment matching.

- Multiple Payment Options: Accept payments via credit card, bank transfer, etc.

Business Impact:

- Reduced Administrative Work: Automation of reminders, payment processing, and reconciliation.

- Faster Payments: Quicker turnaround on invoice payments, improving cash flow.

- Better Customer Experience: A smooth, easy-to-use platform for both you and your clients.

3. Real-World Implementation Success Stories

3.1 Understanding Success Through Data

Before diving into specific case studies, let’s examine how successful implementations typically play out across different industries. Our analysis of hundreds of implementations reveals these common patterns:

| Industry | Company Size | Monthly Invoices | Previous Solution | New Solution | ROI Timeline |

| Manufacturing | Medium | 2,500 | Manual + QuickBooks | Premier BillPay | 45 days |

| Healthcare | Small | 750 | Paper-based | Premier BillPay | 30 days |

| Construction | Large | 5,000 | Legacy ERP | Premier BillPay + ERP | 60 days |

Regardless of industry or size, modern invoice processing solutions can deliver measurable results quickly. Let’s explore two detailed success stories.

3.2 Case Study #1: Manufacturing Excellence – From Paper to Profit

Initial Situation Assessment

When this medium-sized manufacturing client approached us, they were struggling with inefficiencies that were harming operations and vendor relationships.

Key Metrics & Challenges:

- Volume: 2,500 monthly invoices, each a potential source of error.

- Labor-Intensive: 4 full-time AP staff dedicating 80% of their time to manual data entry.

- Payment Cycle: 45-day average, leading to supplier dissatisfaction.

- Late Payments: 15% rate, causing frequent late fees and strained vendor ties.

Cost Breakdown Before Implementation:

| Category | Cost |

| Labor | $18,000/month |

| Software | $500/month |

| Late Payment Fees | $2,500/month |

| Storage (paper/digital) | $300/month |

| Total Monthly Cost | $21,300/month |

The Transformation Journey

Setup & Configuration

Premier BillPay made the onboarding process quick and efficient:

- System Setup: Completed in 4 hours.

- Staff Training: Conducted over 6 hours (split across 3 days).

- Template Creation: Finished in 2 hours.

- Total Setup Cost: $1,200 (well below budget).

Testing Phase

Before full deployment, a controlled testing phase revealed promising results:

- Test Invoices: Processed 100 invoices.

- Success Rate: 98% on the first attempt.

- Issues Found: 2 minor integration problems, resolved in 3 hours.

Full Deployment Results

Within 90 days, the transformation was complete:

- Invoices Migrated: 2,500.

- Automation Rate: 95% (only 5% required manual review).

- Staffing: Reduced from 4 full-time employees to 1.

Post-Implementation Metrics:

| Metric | Before | After | Improvement | Impact |

| Processing Time | 45 days | 3 days | 93% reduction | Improved vendor relations |

| Staff Required | 4 FTE | 1 FTE | 75% reduction | $13,500 monthly savings |

| Late Payments | 15% | 2% | 87% reduction | $2,300 monthly savings |

| Monthly Costs | $21,300 | $4,500 | 79% reduction | $16,800 total monthly savings |

3.3 Case Study #2: Healthcare Provider – Compliance Meets Efficiency

The Compliance Challenge

For this small healthcare provider, maintaining regulatory compliance while improving invoice efficiency was critical. Specific challenges included:

- HIPAA Compliance: Ensuring patient-related financial data met strict confidentiality standards.

- Multi-Location Operations: Managing invoices across three offices.

- Variable Payment Terms: Adjusting for different terms with insurance companies.

- Approval Workflows: Handling multi-level approvals for medical supplies.

The Solution Architecture

To address these challenges, we designed a HIPAA-compliant, automated workflow tailored to the healthcare provider’s needs:

- Secure Receipt & Encryption: Ensured all invoices were protected during transmission and storage.

- HIPAA-Compliant OCR Processing: Automated data extraction without compromising compliance.

- Multi-Level Data Validation: Reduced errors by validating data against predefined rules.

- Automated Compliance Checking: Ensured every invoice met regulatory requirements before processing.

- Role-Based Approval Routing: Streamlined approval workflows by automating routing to the appropriate stakeholders.

- Secure Payment Processing: Completed payments with full encryption for added security.

Full Deployment Results

| Metric | Before | After | Improvement |

| Invoice Processing Time | 30 days | 5 days | 83% reduction |

| Compliance Errors | 10/month | 0 | 100% improvement |

| Staff Time on Invoices | 20 hours/week | 3 hours/week | 85% reduction |

| Monthly Costs | $6,500 | $2,000 | $4,500 saved/month |

3.4 Why These Success Stories Matter

These examples demonstrate the transformative impact of implementing modern invoice processing solutions. Whether for a manufacturing business focused on vendor relations or a healthcare provider prioritizing compliance, the results speak for themselves:

- Reduced Costs: Up to 79% reduction in processing costs.

- Improved Efficiency: Drastic cuts in processing time and labor.

- Enhanced Compliance: Full regulatory adherence with fewer errors.

By tailoring solutions to the unique needs of each business, rapid ROI is achievable across industries and company sizes.

4. The Future of Invoice Processing: AI, Machine Learning & More

The landscape of invoice processing is experiencing swift transformation, driven by cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), blockchain, and real-time payment networks.

This section explores the current trends, future predictions, and the transformative potential of these technologies based on our data (2023 to 2024).

4.1 Current Technological Revolution

A snapshot of the technological adoption in invoice processing reveals significant advancements and exciting prospects:

| Technology | Current Impact (2023) | 2025 Prediction | Key Benefit |

| AI/ML | 45% adoption | 85% adoption | 99.97% data extraction accuracy |

| Blockchain | 15% adoption | 40% adoption | Immutable audit trails |

| Real-Time Processing | 30% adoption | 90% adoption | Instant reconciliation |

| Smart Contracts | 10% adoption | 60% adoption | Automated compliance |

Explainer:

- AI/ML: Accelerating automation with near-perfect data extraction and predictive analytics.

- Blockchain: Ensures transparency and security through tamper-proof ledgers.

- Real-Time Processing: Eliminates delays, allowing for immediate financial reconciliation.

- Smart Contracts: Automates rule-based compliance and payment execution, reducing manual intervention.

4.2 AI & Machine Learning Transformations

AI and ML are the primary drivers of the invoice processing revolution, delivering unparalleled accuracy and efficiency. Here’s how these technologies are making an impact:

Pattern Recognition & Learning

AI-powered systems continuously improve through data analysis and learning:

- Automatic vendor categorization.

- Detection of fraud patterns.

- Prediction of payment behavior.

- Optimization of cash flow.

Example:

Premier BillPay‘s AI engine (Beta Version, Internal Testing) analyzes:

- 1M+ monthly transactions: Identifies trends and anomalies in large datasets.

- 50K+ vendor relationships: Learns vendor preferences and behaviors.

- 100K+ payment patterns: Ensures timely and accurate payments.

Result: A 99.97% accuracy rate in data extraction and processing.

Intelligent Automation Capabilities

- Smart Data Extraction:

- AI understands the context of data.

- AI Learns from corrections over time.

- AI Adapts to new formats and invoice designs.

- Predictive Analytics:

- Optimizes payment timings to prevent cash flow disruptions.

- Accurately forecasts cash flow needs.

- Analyzes vendor behavior to anticipate issues or opportunities.

- Anomaly Detection:

- Real-time fraud prevention alerts.

- Detects duplicate payments before they are processed.

- Identifies pricing discrepancies to reduce overpayments.

4.3 Future Implementation Timeline

The roadmap for invoice processing technology points toward increasingly autonomous and intelligent systems:

| Year | Milestone |

| 2025 | – Full AI-powered processing for invoice management. |

| – Real-time payment networks integrated across industries. | |

| – Predictive vendor management for improved relationships and terms. | |

| 2026 | – Autonomous reconciliation requiring zero human intervention. |

| – Seamless integration of smart contracts for automated compliance. | |

| – Optimization of global payments to handle cross-border complexities. | |

| 2027 | – Quantum-secure transactions to prevent cybersecurity risks. |

| – Cross-chain settlement for blockchain networks. | |

| – Universal payment protocols enabling interoperability between platforms. |

4.4 Transformative Possibilities: Why This Matters

The adoption of advanced technologies will reshape invoice processing in several ways:

- Enhanced Efficiency: Automation will reduce processing times from weeks to minutes.

- Cost Savings: AI-driven accuracy minimizes errors and eliminates redundant workflows.

- Global Standardization: Blockchain and smart contracts enable universal compliance and seamless international transactions.

- Unprecedented Security: Quantum encryption and real-time anomaly detection protect against threats.

With such developments on the horizon, the future of invoice processing is not only promising but transformative, setting new benchmarks for efficiency and reliability across industries.

Conclusion: The Invoicing Revolution for Enterprise is Here

The evolution of invoice processing has moved beyond a luxury to an essential step for businesses seeking efficiency and growth.

Transitioning from manual processes, which cost $15–$20 per invoice, to AI-powered systems costing less than $1, is a transformation no enterprise can afford to ignore.

With implementation timelines as short as 2–3 days, and ROI achievable within 30–45 days, the benefits are immediate and tangible.

By integrating AI/ML, real-time processing, and predictive analytics, your organization can be future-ready today.The question isn’t whether to automate but how to get started. Schedule a demo of Premier BillPay, the most powerful enterprise invoicing solution, and discover the ease of automation. Try it free and see the difference for yourself