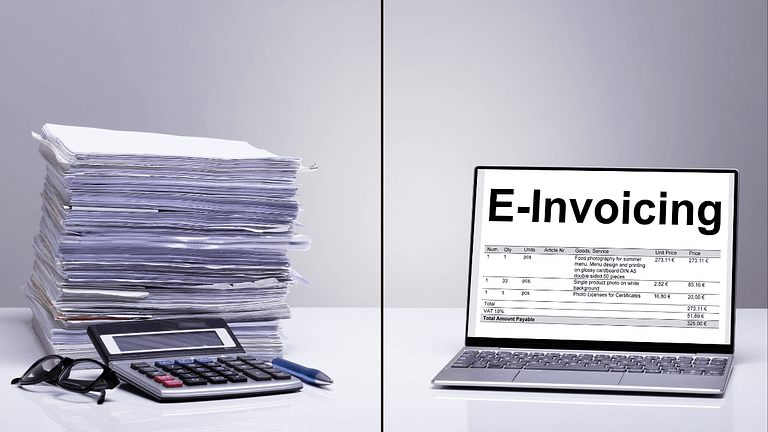

The efficiency of an invoicing process determines how successfully a business can maintain a healthy cash flow and get past the frustration of late payments. For businesses, an effective invoicing procedure is critical to success due to its intricate financial procedures and large transaction volume.

Businesses can enhance operational efficiency, lower the possibility of human mistake, and prevent the annoyances associated with late payments by using simplified, automated invoice processing for enterprise systems.

An efficient invoicing system offers priceless information about the financial well-being of a business. In addition to enabling businesses to assess their historical performance, these insights give them the means to predict growth, make strategic plans, and preserve financial stability in the data-driven business world of today.

The elements of an ideal invoice processing for enterprise systems will be examined in this article, which will also show how technology may revolutionize invoicing processes and help businesses grow effectively.

In this article you will learn:

- What is an invoice?

- What is invoice processing?

- How does invoice processing work?

- Benefits of automated invoice processing

- Invoice processing best practices

- How our invoice automation solution works

What’s an invoice?

An invoice is a formal document that a company sends to a customer or client outlining a transaction and asking for payment. Invoicing is essential for businesses in order to track financial performance, manage accounts payable, and guarantee tax compliance.

An enterprise invoice typically includes:

- Seller Information: Business name, address, and tax identification number.

- Buyer Information: Client’s name, address, and payment details.

- Invoice Number: A unique identifier for easy tracking.

- Issue and Due Date: When the invoice was sent and when payment is due.

- Goods or Services Provided: A clear breakdown of items, quantities, and prices.

- Total Amount Due: The full payment amount, including taxes or additional fees.

- Payment Terms: Agreed-upon terms for payment, including potential late fees.

For enterprises, ensuring accuracy in invoicing is critical to avoiding disputes and maintaining a steady cash flow.

What is “invoice processing for enterprise”?

Invoice processing for enterprise refers to the structured method through which businesses handle incoming and outgoing invoices. It involves multiple steps, from invoice receipt to payment, making sure that financial transactions are recorded and executed efficiently.

In comparison with smaller companies, enterprises handle a large number of invoices and need advanced processing systems to guarantee scalability, accuracy, and compliance. Because manual processing is prone to mistakes, delays, and inefficiencies, it is not a practical alternative.

The Invoice processing for enterprise work?

The invoice processing workflow in enterprises follows this structure:

- Invoice Receipt: The business receives an invoice from a supplier or service provider. This can be in paper format, email, PDF, or an electronic invoicing platform.

- Invoice Capture: The invoice details are extracted and entered into the enterprise’s accounting system, either manually or through automated software.

- Validation and Compliance Check: The invoice is verified against purchase orders, delivery receipts, and contract agreements.

- Approval Workflow: The invoice is routed to relevant personnel for approval based on predefined business rules.

- Payment Processing: Once approved, the invoice is scheduled for payment according to the agreed terms.

- Record-Keeping and Reporting: The invoice and transaction details are recorded for financial audits and reporting.

How using invoice automation software can change the way you process invoices

The way that businesses handle invoicing is changing due to automation. By removing the need for human data entry, invoice automation software for businesses speeds up workflows and shortens the time between invoice receipt and payment approval. Businesses can drastically reduce administrative costs and devote resources to strategic financial planning by reducing manual involvement.

Most importantly, automation ensures accuracy and security by reducing the possibility of human error, duplicate invoicing, and fraudulent transactions. Because invoice automation software verifies and safely maintains invoices for audits, compliance with tax and regulatory requirements is also improved. Businesses may optimize working capital, save late penalties, and better manage payment schedules, all of which will improve cash flow management.

Automated systems offer the scalability required to manage growing invoice quantities effectively without sacrificing speed or accuracy as businesses grow.

Best practices for invoice processing

Businesses can increase productivity by using these best practices:

- Invoice Management in One Place: Businesses should combine all invoice processing operations into a single, integrated platform to guarantee uniformity, visibility, and easy access to financial data.

Businesses can improve monitoring capabilities, expedite approval processes, and lessen inefficiencies brought on by dispersed data by centralizing invoice management. By keeping organized financial records, a unified system helps firms keep an eye on transactions, spot irregularities, and enhance overall financial control.

- Standardized Processes for Approval of Invoices: To avoid delays and guarantee departmental accountability, it is crucial to establish precise and well-defined criteria for invoice approvals.

Businesses may guarantee that invoices are reviewed and approved effectively, cut down on invoice errors, and remove bottlenecks by putting in place a systematic approval procedure.

- Three-Way Accuracy Matching: Businesses should use a three-way matching process that compares invoices with matching purchase orders and receiving papers to avoid inconsistencies and improper payments. This procedure lowers the possibility of overpayments, fraud, or billing errors by ensuring that all financial transactions are verified prior to payment.

Businesses can improve financial integrity and keep accurate records for audits and compliance by methodically comparing invoice data with procurement records.

- Using Automation to Increase Productivity: Businesses should use AI-powered solutions for invoice scanning, validation, and approval in order to speed up invoice processing and reduce manual labor. By swiftly extracting pertinent information from invoices, identifying mistakes, and comparing them with purchase orders, automated systems lower the possibility of human error.

- Frequent Verification and Compliance Audits: Maintaining operational openness and avoiding financial penalties require that all invoices comply with government tax laws, industry rules, and corporate standards. To ensure that invoices are accurate, identify fraudulent transactions, and fill up any regulatory gaps, businesses should conduct regular compliance checks.

Businesses can lower financial risks, gain the trust of regulatory bodies, and create a dependable invoicing system by carrying out routine audits and upholding a robust compliance framework.

- Relationship Management and Vendor Communication: Efficient dispute resolution and the development of enduring relationships with suppliers depend on maintaining open, honest, and proactive communication.

To prevent misconceptions, businesses should set up clear payment terms, deal with inconsistencies right away, and update vendors on the status of their invoices.

How Premier Payments Online improve invoice processing for enterprise

Premier Payment Online has become an industry-leading invoice automation software designed especially for enterprises and small businesses. Here’s how they create more efficient enterprise invoicing:

- Smooth Creation and Processing of Invoices: The digital invoicing solutions from Premier Payments Online enable companies to quickly and accurately create, modify, and send invoices.

Businesses may cut down on errors, improve the invoicing process, and save administrative expenses by doing away with the requirement for paper documentation. By ensuring that invoices are received on time, the platform enhances cash flow management and payment cycles.

- Efficiency through Intelligent Automation: Important invoicing procedures like invoice capture, approval routing, and payment scheduling are automated using Premier Payments Online. This removes obstacles that slow down invoice processing and lessens the manual workload for finance professionals.

Businesses can concentrate on strategic financial planning and operational expansion while guaranteeing on-time payments by using automation to handle monotonous duties.

- Transactions that are safe and compliant: Premier Payments Online simplifies financial reporting and audits by guaranteeing compliance with tax laws, industry standards, and security protocols.

The platform’s integrated compliance checks protect companies from fraud and regulatory threats by assisting them in maintaining accurate records and avoiding expensive fines. Businesses can be sure that every transaction is carried out securely thanks to data encryption and secure payment processing.

- Smooth Integration with Accounting and ERP Software: Accounting software and enterprise resource planning (ERP) systems can be easily integrated with Premier Payments Online. Real-time updates, precise financial data tracking, and efficient processes are all guaranteed by this synchronization.

Companies can improve reporting and decision-making accuracy by maintaining a single source of truth for all financial transactions.

The landscape of invoice processing for enterprise is evolving quickly, with automation and digital transformation playing a key role.

To preserve a strong financial environment, businesses must give efficiency, accuracy, and compliance first priority when it comes to their invoicing procedures.

Premier Payments Online gives companies the resources they need to improve cash flow management, streamline invoicing processes, and guarantee compliance. Businesses can scale their operations and provide the groundwork for long-term financial success by utilizing best practices and enhanced automation.

Find out more about how Premier Payments Online can transform the way your business processes invoices.