This article delves into the world of intelligent payment routing and its impact on modern business transactions. We examine the mechanics behind this technology, contrast static and dynamic routing approaches, and outline the concrete advantages for companies across various sectors.

The content covers practical implementation methods, international expansion possibilities, and specific applications for merchants in high-risk categories. Our goal is to provide readers with a clear roadmap to reduce transaction costs, increase approval percentages, and boost customer satisfaction through intelligent payment routing solutions.

What Is Intelligent Payment Routing?

Intelligent payment routing serves as a strategic system that directs payment transactions through optimal processing channels based on specific parameters and real-time data analysis. Unlike conventional payment methods that rely on fixed pathways, intelligent payment routing adapts dynamically to select the best route for each individual transaction, maximizing success rates while keeping costs at a minimum.

The core function of intelligent payment routing acts as a decision engine within the payment ecosystem. When customers initiate a purchase, the routing system evaluates numerous factors to determine the most efficient processing path:

- Transaction value

- Payment method type

- Card category

- Customer geographic location

- Merchant classification

- Past performance metrics

- Current processor status

- Fee structures across providers

After a thorough analysis of these elements, the system selects the path most likely to result in approval with the lowest possible cost structure.

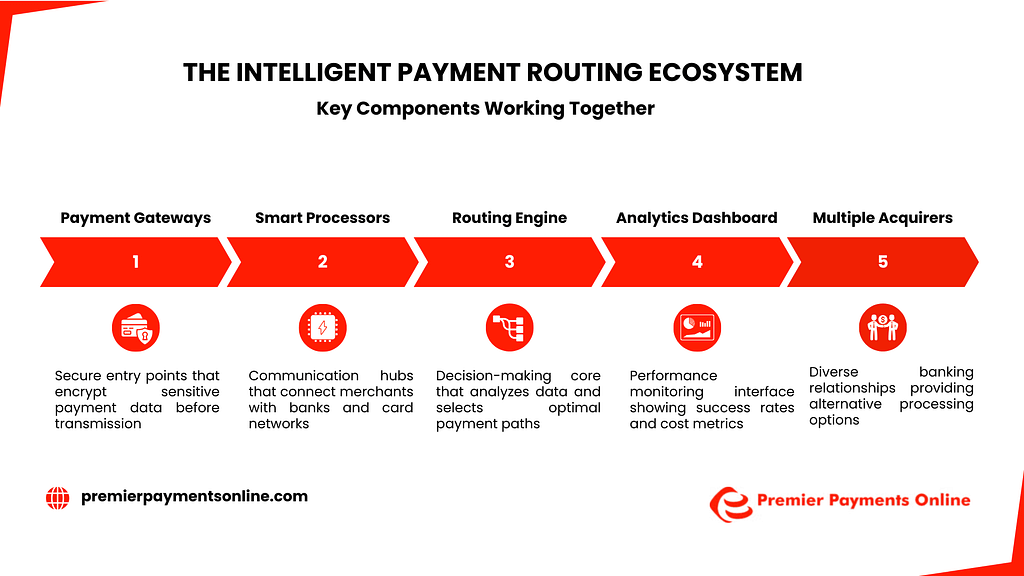

The Payment Routing Ecosystem

To fully grasp the concept of intelligent payment routing, one must first understand the components that make up the payment processing ecosystem:

| Component | Function in Payment Routing |

| Payment Gateways | Initial transaction entry point; encrypt payment data before forwarding to processors |

| Payment Processors | Manage communication between merchants, card networks, and financial institutions |

| Acquiring Banks | Financial entities that hold merchant accounts and receive transaction funds |

| Card Networks | Organizations such as Visa and Mastercard that facilitate transactions between banks |

| Alternative Payment Methods | Non-card options like digital wallets or direct bank transfers |

| Payment Service Providers | Companies that deliver payment processing services to business clients |

Intelligent payment routing coordinates the interactions between these entities to create optimized paths for various transaction types.

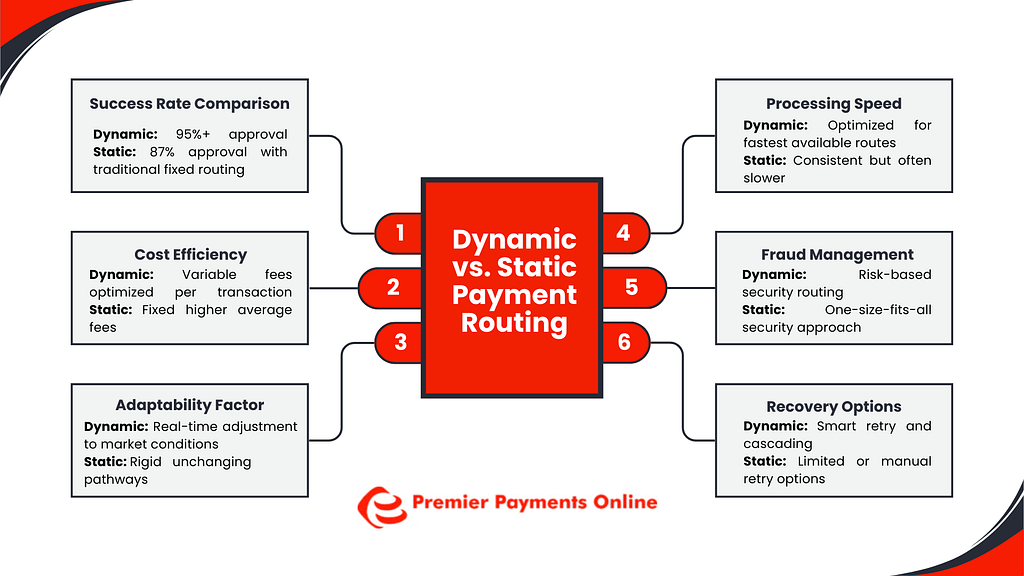

Dynamic vs. Static Payment Routing

The contrast between dynamic and static routing marks a fundamental shift in payment processing philosophy:

| Static Routing | Dynamic Routing |

| Uses preset, unchanging paths for all transactions | Modifies routing decisions in real-time based on multiple factors |

| Simple to implement, but lacks adaptability | More complex but delivers significant advantages |

| Unable to adjust to changing conditions | Automatically responds to processor outages or performance issues |

| Limited scope for optimization | Constantly refines processes for cost and approval rates |

| Consistent but inflexible processing | Adaptable processing that maximizes success rates |

Intelligent payment routing utilizes dynamic routing methods to adjust to market fluctuations, processor performance metrics, and customer preferences. This adaptability proves crucial in the ever-changing payment landscape, where new payment methods continually emerge and processing conditions rapidly evolve.

Major Advantages of Intelligent Payment Routing

The implementation of intelligent payment routing offers several concrete benefits that directly affect a company’s financial performance:

Better Authorization Rates

By directing transactions through processors most likely to approve them, businesses can achieve notable improvements in authorization rates. This translates to fewer declined transactions and more completed sales, directly impacting revenue.

Find out more about payment election processing times

Lower Processing Expenses

Various processors charge different fees based on transaction types, regions, and payment methods. Smart routing selects paths with optimal fee structures, which can substantially reduce overall processing costs for merchants.

Superior Customer Experience

Fast, smooth payment processing directly correlates with customer satisfaction levels. When customers experience fewer declines and faster transaction times, their overall shopping experience improves dramatically, leading to higher retention rates.

Effective Failure Management

If a transaction fails with one processor, intelligent routing can automatically attempt the transaction through alternative paths, increasing the success probability without requiring customer intervention.

Advanced Fraud Management

Modern routing systems can direct suspicious transactions through processors with more robust payment fraud detection capabilities. This helps merchants strike the perfect balance between security measures and approval rates.

Payment fraud analytics plays a crucial role in this process, as the system learns from each transaction to better identify potential threats. The most advanced systems incorporate payment fraud prevention measures directly into their routing decisions.

Global Transaction Optimization

For companies with international operations, intelligent routing can direct transactions through local payment service providers to boost acceptance rates and minimize cross-border fees and currency conversion costs.

The Mechanics Behind Intelligent Payment Routing

Intelligent payment routing operates through a sophisticated process that combines data analysis with strategic decision-making:

- Transaction Start: The customer submits payment details through the merchant’s checkout system.

- Data Evaluation: The routing system assesses multiple parameters, including:

- Card data (BIN number, issuing bank, card type)

- Transaction specifics (amount, currency, product category)

- Customer information (location, device, transaction history)

- Current processor performance metrics

- Fee structures across available processors

- Route Selection: Based on this comprehensive analysis, the system picks the optimal processing path.

- Transaction Processing: The payment information travels through the selected route.

- Response Management: The system receives the processor’s response (approval or decline).

- Cascading (when necessary): For declined transactions, the system may automatically route through an alternative path.

- Data Collection: Performance data from each transaction is fed back into the system to inform future routing decisions.

- Continuous Refinement: Advanced algorithms analyze transaction patterns to improve routing rules over time.

This system must adapt to new payment fraud detection techniques and integrate them into its decision-making process. By constantly analyzing patterns, the routing system can contribute significantly to payment fraud prevention efforts.

Practical Implementation Methods for Intelligent Payment Routing

The successful implementation of intelligent payment routing requires thoughtful planning and attention to several key factors:

Multiple Payment Processing Relationships

The foundation of effective routing lies in establishing relationships with multiple payment processors. This creates a diverse set of options for the routing system to choose from based on various transaction characteristics.

Learn about our PCI compliance solutions

Clear Routing Guidelines

The creation of well-defined routing rules based on business priorities helps ensure the system makes decisions aligned with company goals, whether focused on approval rates, cost reduction, or fraud prevention.

Data Systems Integration

Connecting payment infrastructure with data sources that provide insights into processor performance, fee structures, and customer behavior enables more informed routing decisions and better transaction outcomes.

Continuous Testing Programs

Regular testing of different routing strategies helps identify the most effective approaches for specific business models and customer segments, leading to ongoing optimization.

Discover our enterprise invoice processing solutions

Intelligent Payment Routing for International Expansion

For businesses looking to expand globally, intelligent payment routing offers distinct advantages:

| Challenge | Solution Through Intelligent Routing |

| Regional Payment Preferences | Routes transactions through locally preferred payment methods |

| Cross-Border Fee Structures | Minimizes fees by selecting optimal regional processing paths |

| Local Regulatory Compliance | Directs transactions through fully compliant processors |

| Currency Exchange Rates | Routes to processors with favorable conversion rates |

| Regional Authorization Success | Select processors with proven approval rates in specific regions |

By leveraging local payment service providers and accommodating regional payment preferences, companies can significantly improve their global payment acceptance rates. This capability makes intelligent payment routing an essential tool for businesses entering new international markets.

Online payment fraud detection becomes even more critical in global markets, where transaction patterns vary widely by region. Advanced routing systems incorporate these regional differences into their fraud analysis models.

Special Considerations for High-Risk Merchants

Businesses classified as high-risk face unique challenges in payment processing. Intelligent payment routing offers tailored solutions for these merchants:

Processor Diversity

High-risk merchants typically encounter higher decline rates and processing fees. By diversifying across multiple processors that specialize in high-risk industries, these businesses can improve their approval rates and negotiate more favorable terms.

Explore our high-risk merchant solutions

Risk-Based Transaction Routing

Transactions can be routed based on their risk profile, with higher-risk transactions directed to processors with more sophisticated payment fraud analytics capabilities and specialized risk assessment tools.

Chargeback Reduction

Intelligent routing can help identify patterns that lead to chargebacks and adjust processing strategies accordingly, reducing the risk of exceeding chargeback thresholds that could lead to account terminations.

Advanced Capabilities in Modern Payment Routing Systems

Today’s payment routing platforms offer sophisticated features that extend beyond basic path selection:

Comparative Testing

Modern systems can compare the performance of different routing strategies to identify the most effective approach for specific transaction categories and customer segments.

Intelligent Retry Logic

Advanced platforms automatically retry declined transactions through alternative paths based on specific decline reasons, significantly increasing overall approval rates.

Learn more about processed payments

AI-Powered Optimization

Cutting-edge systems use artificial intelligence to continuously analyze transaction data and refine routing rules based on emerging patterns and success metrics.

Live Performance Monitoring

Top-tier platforms track processor performance in real time to quickly identify and respond to outages or performance degradation across the payment ecosystem.

Custom Rules Development

The most flexible systems allow for complex routing rule creation based on multiple parameters to address specific business requirements and market conditions.

Key Points to Remember

- Intelligent payment routing creates optimal transaction paths based on multiple factors to improve approval rates and reduce costs.

- Dynamic routing delivers major advantages over static routing by adapting to changing conditions in real time.

- Businesses gain higher approval rates, lower processing costs, and better customer experiences.

- Global expansion becomes more manageable with intelligent routing that accommodates regional payment preferences and regulations.

- High-risk merchants receive specific benefits through processor diversification and risk-based routing strategies.

- Advanced routing systems use AI technology to continuously optimize transaction paths based on performance data.

Premier Payments Online Upgrades Your Payment Operations

Ready to transform your payment operations with intelligent payment routing? Premier Payments Online offers customized payment solutions with smart transaction routing capabilities designed to increase your approval rates while reducing costs.

Our team of payment experts can develop a personalized routing strategy aligned with your specific business requirements, whether you operate domestically or internationally, in standard or high-risk sectors.

Final Thoughts

Intelligent payment routing represents a major advancement in payment processing technology, giving businesses powerful tools to optimize transaction paths, cut costs, and enhance customer experiences. By dynamically selecting the ideal processing route for each transaction based on multiple factors, these systems help merchants maximize approval rates while minimizing fees.

As the payment landscape continues to evolve with new payment methods, processors, and regulatory requirements, intelligent routing becomes increasingly valuable. Businesses that adopt this technology gain a competitive edge through more efficient payment operations and higher customer satisfaction levels.