The transportation industry increasingly recognizes that benefits carrier invoice processing provides extend far beyond basic automation. Companies seeking to modernize their operations find that streamlined payment systems create measurable improvements across their entire business.

Our experience working with freight companies has shown that implementing electronic invoice systems transforms daily operations.

The Evolution of Freight Payment Systems

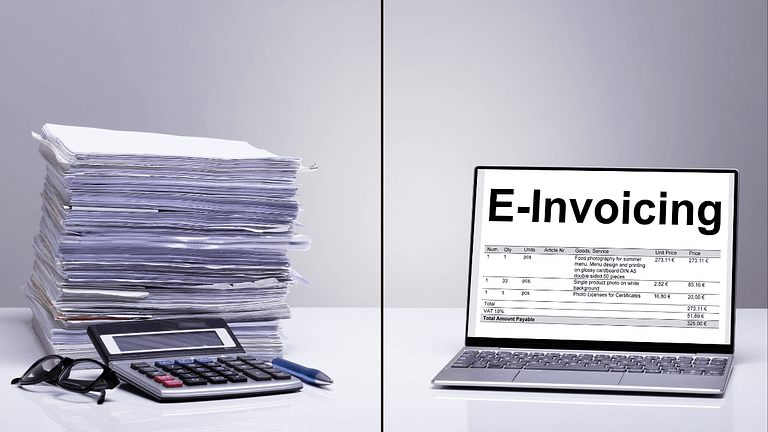

The freight industry has witnessed major changes in payment processing over the past decade. Traditional manual systems created bottlenecks that modern businesses can’t afford. Today’s benefits carrier invoice processing stems from years of technological advancement and industry feedback. Companies implementing electronic invoice systems report dramatic improvements in efficiency and accuracy compared to legacy methods.

Transportation companies previously relied on paper-based systems that required extensive manual entry and verification. This approach led to frequent errors, delayed payments, and strained relationships with carriers. The shift toward digital processing hasn’t just modernized operations; it’s fundamentally changed how companies manage their freight payment ecosystems.

1. Current Challenges in Transportation Payment Management

Before exploring specific benefits carrier invoice processing delivers, it’s crucial to understand the challenges modern freight companies face. Our work with transportation providers reveals consistent pain points in payment management. Many companies struggle with payment accuracy, processing speed, and maintaining PCI compliance across their operations.

These challenges often result in:

- Extended payment cycles that strain carrier relationships

- High processing costs that eat into profit margins

- Compliance risks from inadequate documentation

- Limited visibility into payment status and history

Modern invoice processing solutions address these issues head-on, providing frameworks for efficient, secure payment management. Understanding these challenges helps explain why proper processing systems have become essential for competitive freight operations.

2. How Benefits Carrier Invoice Processing Impacts Bottom Lines

The freight industry relies heavily on accurate, timely invoice management. Many businesses struggle with outdated systems that slow down operations and create unnecessary costs. By upgrading to modern invoice processing for enterprise, companies can address these challenges head-on.

3. Key Advantages of Advanced Processing

Invoice processing costs directly impact profitability. Most transportation companies spend significant resources on manual invoice handling. Our analysis shows that switching to automated systems typically reduces processing expenses by 50-70%. One regional carrier saved $120,000 annually after implementing digital processing through our bill pay solutions.

1. Cost Reduction Through Automation

Manual invoice processing burns through resources faster than a truck burns through diesel. One of our clients used to employ three full-time staff members just to handle carrier invoices. After implementing automated invoice processing for enterprise, they cut processing costs by 60% and reassigned two team members to growth-focused roles.

The savings don’t stop at labor costs. When invoices are processed automatically, you catch billing errors that would otherwise slip through the cracks. Double charges, incorrect rates, and mathematical errors get flagged instantly. One mid-sized logistics company recovered $50,000 in overcharges during their first year using automated processing.

2. Faster Payment Cycles

Nothing strains carrier relationships like late payments. Traditional invoice processing often takes 20-30 days, leaving carriers frustrated and potentially impacting service levels. Modern processing through solutions like our bill pay platform cuts that time down to 2-5 days on average.

Here’s what the improvement in payment cycles typically looks like:

| Processing Stage | Traditional Method | Automated Processing |

| Invoice Receipt | 1-3 days | Same day |

| Data Entry | 2-5 days | Instant |

| Validation | 3-7 days | 1-2 days |

| Approval | 5-10 days | 1-2 days |

| Payment Processing | 3-5 days | 1 day |

| Total Timeline | 14-30 days | 2-5 days |

3. Better Cash Flow Management

When you can process invoices quickly, you gain control over your cash flow. Instead of scrambling to pay carriers whenever invoices finally make it through the system, you can strategically time payments to optimize your working capital.

This improved visibility also helps with budgeting and forecasting. You’ll know exactly how much you owe carriers at any given time, making it easier to plan for future expenses. Plus, faster processing means you can take advantage of early payment discounts, which typically range from 1-2% of the invoice amount.

4. Enhanced Security and Compliance

In transportation, security isn’t optional. Every invoice contains sensitive information that needs protection. Modern carrier invoice processing includes built-in security features that comply with PCI DSS standards. This means your data – and your carriers’ data – stays safe throughout the entire process.

4. Real-Time Visibility

Gone are the days of digging through filing cabinets or searching endless email threads to find an invoice. With digital processing, every invoice and its status is available instantly. This visibility extends to your carriers too – they can check payment status without calling your accounts payable team.

A major trucking company we work with used to spend hours each week responding to payment status inquiries. After implementing enterprise invoice processing, these inquiries dropped by 80% because carriers could access the information themselves.

5. Improved Carrier Relationships

Happy carriers mean reliable service. When you pay promptly and handle invoices efficiently, carriers are more likely to prioritize your loads during capacity crunches. They’re also more likely to work with you on rates and be flexible when you need special arrangements.

6. Better Data for Better Decisions

Every invoice contains valuable data about your shipping patterns, costs, and carrier performance. Modern processing systems capture this data automatically, giving you insights that would be impossible to gather manually. You can spot trends in carrier pricing, identify lanes where costs are increasing, and make informed decisions about carrier selection.

4. Proven Benefits Carrier Invoice Processing Success Stories

Transportation companies implementing modern processing systems report significant improvements across multiple metrics. A nationwide logistics provider partnered with us to overhaul their invoice management system. Within six months, they processed invoices 75% faster while reducing processing costs by $200,000 annually. Their success hinged on proper PCI compliance implementation and staff training.

Another mid-sized carrier saw dramatic improvements after upgrading from paper-based systems. By implementing electronic invoice processing, they reduced invoice exceptions by 85% and shortened their average payment cycle from 45 to 5 days. This improvement strengthened their carrier relationships and helped secure better rates during peak seasons.

5. Measuring Return on Investment

Understanding the financial impact of benefits carrier invoice processing requires examining multiple factors. Our analysis of client data reveals consistent patterns:

| ROI Component | Average Improvement | Annual Impact |

| Processing Time | 80% reduction | $75,000 savings |

| Error Rate | 95% reduction | $120,000 savings |

| Early Payment Discounts | 1.5% of invoice value | $180,000 savings |

| Staff Efficiency | 65% improvement | $90,000 savings |

| Carrier Retention | 35% improvement | $250,000 value |

Companies implementing comprehensive invoice processing solutions typically see full return on investment within 6-8 months.

Taking the Next Step

If you’re still handling carrier invoices the old-fashioned way, you’re leaving money on the table and potentially straining carrier relationships. Modern carrier invoice processing isn’t just about paying bills – it’s about optimizing your entire freight payment operation.

Ready to see how automated invoice processing could transform your business? Contact us to learn more about our secure, efficient payment solutions tailored for transportation companies. We’ll show you exactly how much time and money you could save with modern processing tools.

For over 15 years, we’ve helped companies streamline their payment processes while maintaining the highest security standards. Let us help you take control of your carrier invoice processing and free up resources for growing your business.